I’m Isaac Saul, and this is Tangle: an independent, ad-free, subscriber-supported politics newsletter that summarizes the best arguments from across the political spectrum on the news of the day — then “my take.”

First time reading? Sign up here. Would you rather listen? You can find our podcast here.

Today's read: 11 minutes.

We're covering the inflation issue (again). Plus, a reader asks if my Covid-19 diagnosis has changed my perspective, and a preview on tomorrow's Friday edition.

Thank you.

I really appreciate the outpouring of love and sympathy yesterday after sharing my Covid-19 diagnosis. Thank you all for your messages, tips, advice, and support. It feels a bit like a nasty cold, but my symptoms today are basically the same as yesterday’s, maybe even a little better. So being young, healthy, and fully vaccinated, I'm hoping to run this thing over quickly. I'm also going to try to finish out the work week, though there will not be a podcast today because I am still quite congested.

That being said, I do urge you all to take some extra precautions before your holiday trips, so you don't face the same conundrum I'm in. Britain just had its highest daily total of new cases ever yesterday. The U.S. new daily case number was 145,000 yesterday. The NFL and NBA are facing uncontrolled spreads. Whatever this is, "something is definitely happening," as the doctor at my Brooklyn clinic told me yesterday. So please be careful.

Quick hits.

- Congress passed its annual defense bill, authorizing $770 billion for defense spending in the fiscal year 2022. (The bill)

- The Biden administration will award three Medals of Honor to soldiers today, the nation's highest military award. (The honor)

- Democrats appear ready to punt their social spending and climate change bill into 2022. (The story)

- The remaining U.S. and Canadian missionaries kidnapped in Haiti have been released, according to local police. (The release)

- The Federal Reserve said it will further accelerate the tapering of its asset purchases and expects to raise interest rates in 2022. (The rates)

Today's topic.

Inflation. This was going to be yesterday's newsletter topic, before the Covid-19 test upended my day.

On Friday, the U.S. government reported that consumer prices jumped 6.8% over the past year, the highest rate of inflation in 39 years. Prices also rose 0.8% month to month over November.

Reminder: Inflation is measured with the Consumer Price Index (CPI), which is designed by the Bureau of Labor Statistics to measure price fluctuations for urban buyers, who represent the vast majority of Americans. The CPI tracks 80,000 items in a fixed basket of goods and services, representing everything from gasoline to apples to the cost of a doctor's visit.

Because food and energy prices are volatile, there's also the "core CPI" — a measure of prices that excludes them. In this case, the core CPI was up 0.5% for the month and 4.9% from a year ago, which is the sharpest rise since 1991.

Inflation is an issue that touches every American. The higher the inflation, the less every dollar you have can get you in the market. For instance, for some Americans, a raise at work could be wiped out over the course of a year by the rising cost of gasoline or food. In this inflation spike, gasoline (up 33%) and food (up 6%) have continued to be the primary drivers, but housing costs are up too.

All of this, like everything else, is tied at least in part to the pandemic. Experts have continued to point to pent-up consumer demand meeting rising wages, as well as supply chain bottlenecks. All of which have been pushed along by the millions of Americans who saved money during the pandemic, or "returned" to more regular day-to-day activities (like driving or eating out) sooner than expected.

How do you stop it? Well, that's part of the debate. In isolation, reducing the cost of a specific good like gas requires a global effort — either compelling other nations to increase oil production (to improve supply) or simply fewer Americans driving due to seasonal demands.

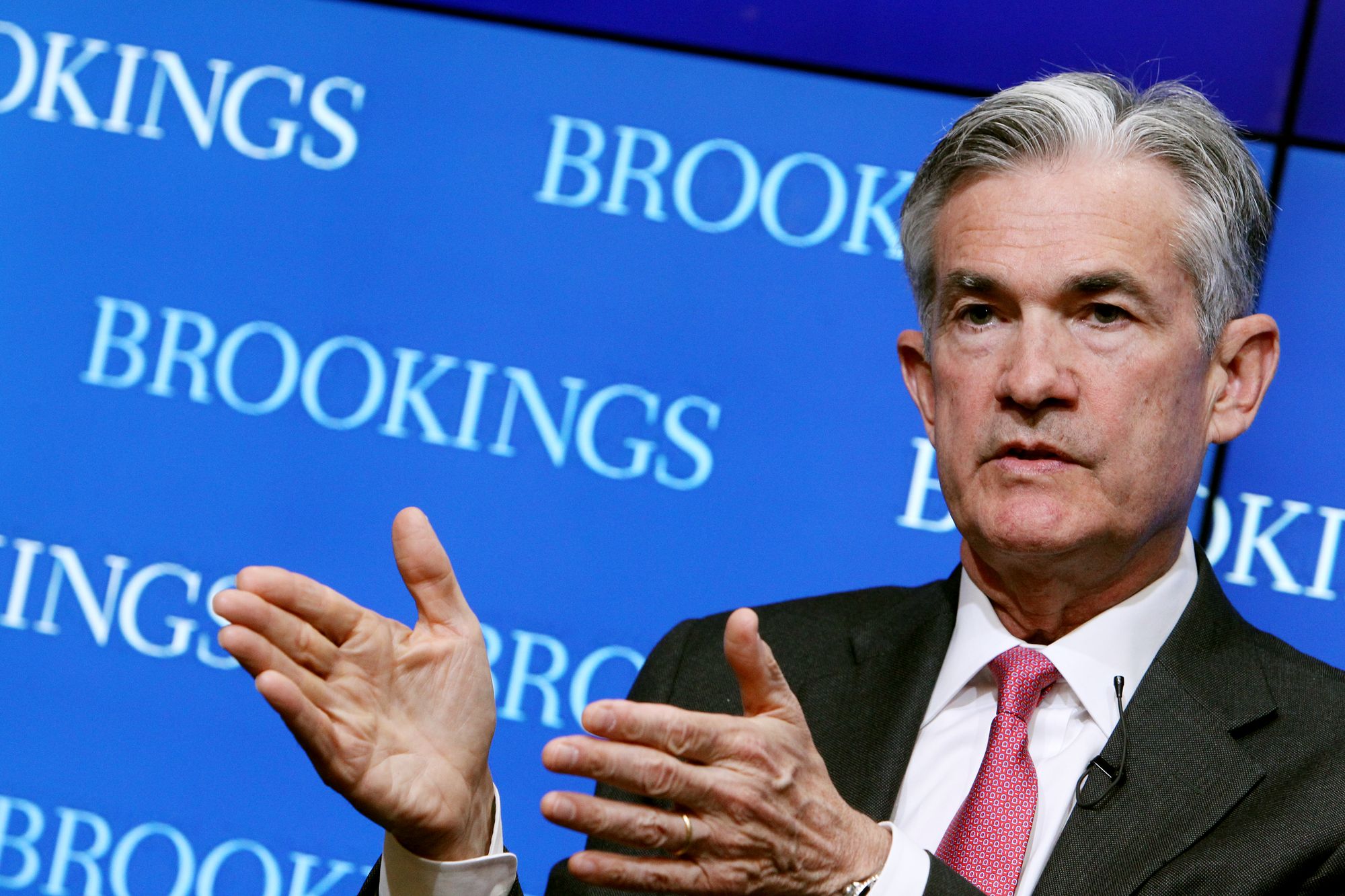

But traditionally speaking, it's the job of the Federal Reserve, America's central bank. The Fed is responsible for setting things like interest rates, which can be used to mitigate inflation. If inflation is high, for example, the Fed could increase interest rates, which would dissuade certain spending by contracting the monetary supply — thus slowing inflation (For a simple explanation on this, go here). In fact, just this week, the Fed indicated it was planning three interest rate hikes in 2022, a sign they are ready to move to slow inflation.

How much does it matter? According to a new CNBC poll, inflation is now the No. 1 concern for voters, eclipsing coronavirus, immigration, crime and climate change. Another Wall Street Journal poll saw about one-third of respondents cite an economic issue when asked about the most important issue for Biden and Congress to address, with 10% citing inflation. Despite steady job growth, wage increases and lowering unemployment, Americans polled across the country feel overwhelmingly negative about the economy, which many have chalked up to the impact of inflation.

This is our third issue on inflation, and will probably be our last for a little while. We covered it in October here, and in November here. Below, we'll take a look at some of the latest commentary from the left and right, then my take.

What the right is saying.

- The right is imploring the Fed to take action.

- They say Biden’s Build Back Better plan should be off the table.

- They criticize Democrats for not taking the threat more seriously.

In The Wall Street Journal, Kevin Warsh said the Fed is the main inflation culprit.

“Inflation is a choice,” he wrote. “It’s a choice for which the Fed is chiefly responsible. The risk of an inflationary spiral arises when policy makers first dismiss the problem and then cast blame elsewhere. Inflation becomes embedded in the price-formation process when the central bank acts belatedly or with insufficient conviction. To date, the Fed has acted as an enabler.

“'Supply-chain bottlenecks' is the popularized rationalization for the surge in prices. But the supply-chain story sheds more shade than light. Consumer prices are higher because prices are rising at the points of production, assembly and transportation. This is a description of the state of affairs, not its source. The Fed’s inertia in withdrawing extraordinary monetary policy—amid full employment—is the proximate cause of surging prices,” Warsh added. “If the Fed doesn’t act with due speed and skill, inflation—the most regressive tax of all—will do further harm, particularly to the least well-off. If the central bank lurches into a significant, unexpected rate-rising cycle, the same hardworking Americans will bear the brunt of an economic slowdown.”

In The New York Times, Glenn Hubbard said the Fed needs to act and Biden needs to pause his economic agenda.

"Policymakers injected three rounds of fiscal stimulus into the pandemic-afflicted economy,” Hubbard wrote. “The most recent round sat atop stored-up household savings of at least $2 trillion, according to recent estimates. Those savings were accrued from earlier rounds of stimulus, as well as an improving labor market. A new infrastructure bill and the possible passage of Mr. Biden’s Build Back Better agenda offer additional deficit financing and a push to demand," Hubbard wrote. "Higher inflation is not a victimless crime. Middle-income savers and retired people on fixed incomes face danger from higher inflation. And workers whose wages don’t keep up with rising inflation are in a similar boat.

"The Fed should also raise its benchmark federal funds rate in early 2022. This is a short-term interest rate at which banks borrow and lend reserve balances with one another," Hubbard said. "If [Fed chairman Jerome] Powell fails to change the Fed’s course now, the current levels of high inflation will begin to affect long-term inflationary expectations. When consumers and businesses expect inflation to be high, it becomes more embedded in economic decision making — things like business investments or negotiating for higher wages. The only way to fix this would be a sharp, quick contraction in the form of higher interest rates and the selling off of assets by the Fed. But such a sudden reversal could set off a recession. Prudent risk management, instead, would have the Fed tightening financial conditions gradually — starting now."

In The Washington Post, Henry Olsen said inflation numbers are "only going to get worse."

"The most recent monthly increases are even more troubling," Olsen said. "Inflation for the past two months has averaged 0.85 percent. If these hikes continue over the next three months, the headline inflation rate would approach 9 percent by spring. If they persist for a year, it would surpass 10 percent — the first time the United States would have double-digit inflation since the early 1980s.

"These facts are an indictment of President Biden’s entire economic team," he added. "They have consistently played down inflation’s threat all year. They pooh-poohed the warnings from former treasury secretary Lawrence H. Summers, a Post contributor, that the American Rescue Plan’s massive size would stoke inflation. Then they said initial upticks in prices were simply statistical glitches caused by the dramatic price drops during the pandemic’s initial phase and would fade away once that glitch dropped out of the calculations."

What the left is saying.

- The left agrees that the Fed needs to take action, but also believes Biden's Build Back Better plan could help ease inflation.

- Many do not think additional federal spending would make inflation worse, especially at the levels being proposed.

- They criticize Republicans for not having their own clear plan to address it.

In CNN, Mark Wolfe said this is a great chance to help lower-income Americans deal with rising inflation.

"While there is no specific program to help low-income families adjust to high inflation, the Build Back Better bill, the large social welfare and energy bill being considered by Congress, is our best chance at helping low-income families deal with rising prices and the continuing economic pain associated with the pandemic," Wolfe wrote. "Among the most important changes is that the bill would extend increases to the child tax credit that the American Rescue Plan put in place earlier this year. The loss of those funds, which currently expire at the end of the month, would be devastating to millions of low-income families and would make it much harder for them to address rising prices.

"About 91% of families with incomes of less than $35,000, according to a recent analysis of Census Bureau data by the Center on Budget and Policy Priorities, have reported using their expanded child tax credit payments for basic expenses like food, clothing, housing and utilities," Wolfe wrote. "And 40% of these families used their payments to cover education costs, like school books and supplies, tuition and after-school programs... Some might argue that the government can't afford to provide these benefits. But the reality is we cannot afford to fail families who are suffering due to economic factors that are out of their control."

In his newsletter, Noah Smith wrote about the four reasons Build Back Better wouldn't make inflation worse.

One big one, he wrote, is that "the bill just isn’t that big, size-wise. Together, the three Covid relief bills in 2020 and 2021 totaled $3.4 trillion — about 8% of two years of U.S. GDP. In comparison, the Build Back Better bill has now shrunk to $1.75 trillion over 10 years, which will be about half a percent of U.S. GDP over that time. In other words, relative to GDP, BBB is 1/16th as large as Covid relief was. Even if you believe Covid relief contributed substantially to the inflation we’re currently experiencing, you probably don’t have to worry about something that’s 1/16th as large.

"In both simple theories and complicated models, it’s deficits that have the biggest effect in terms of raising aggregate demand and pushing up inflation," he added. "Biden’s bill has some expensive tax cuts (increasing the cap on the SALT deduction being the biggest by far), but overall it raises taxes. Most of these increases come in 2027 or later. So for the first few years, the CBO predicts that BBB’s impact on the deficit will be approximately equal to its overall spending. But starting in 2027, it will actually cut the deficit!... The Fed is tapering quantitative easing, and will likely increase the rate of the taper very soon. Talk of rate hikes is increasing. And the tightening seems to be working. The 5-year breakeven inflation rate — a measure of the market’s expectations for inflation over the next 5 years — surged in October and early November but has now come down off its recent highs."

In The Washington Post, Paul Waldman asked what Republicans' plan is.

"For all their criticism and concern, what do Republicans actually think we should do about inflation? If your answer is 'I have no idea what Republicans would do,' you’re not alone," Waldman wrote. "They themselves don’t seem to know. Look at statements from Republican officeholders and conservative think tanks and you’ll see plenty of extravagant blame-placing but very few concrete recommendations. The occasional conservative will suggest that the Federal Reserve should 'cool the economy' — i.e., raise interest rates to slow growth and restrain demand — but the political implications of that idea are too volatile for Republicans to fully embrace.

"You can get a clearer answer from Republicans on what we shouldn’t do: pass the Build Back Better bill, because they claim it’s just more government spending, and that’s bad," they wrote. "When they make that claim, they studiously avoid the question of what we actually spend money on. Republicans don’t worry about inflation when they vote to spend trillions of dollars on the military. It’s only when Democrats propose spending that might improve people’s lives that Republicans suddenly begin squawking about inflation."

My take.

I'm encouraged by the Fed's recent announcements. I've said all along that the threat of inflation was real, and that the Americans being hit hardest by it were the ones both parties constantly try to stake a claim over: Lower-income, working class people. The price of a loaf of bread or a gallon of gas may fluctuate without notice for many in the upper-middle class, but it's impossible to ignore when you're living on a tight budget or supporting a family in a lower economic bracket.

Noah Smith's argument that the Build Back Better legislation has a low to non-existent threat of making inflation worse is also compelling. I've interviewed Smith before, and I think he's an incredibly reliable source and a straightforward guy, even if he's prone to left-leaning biases. Still, I haven't seen many folks address his arguments directly, specifically that even if you believe the contested notion that federal spending like the Covid-19 stimulus increased inflation substantially, the BBB plan represents a tiny fraction of that spending over an extended time span with good scores from the nonpartisan CBO.

Unfortunately for Democrats, from a political context, this debate is going to be very difficult to win. It makes intuitive sense that more dollars in the economy (i.e. more federal dollars going to Americans) would increase demand, which will help increase cost. It takes Smith, an economics professor who is better at speaking in layman's terms on this stuff than most economists I know, a good deal of complex analysis about economic principles to explain why these concerns are overblown. I have no idea how that translates as a political message.

A few months ago, I said pretty clearly that the division among economists makes me very unsure about how all this would play out. When the Harvard economists and Nobel Prize winning economists are arguing, it feels kinda silly for me to poke my head up and opine. But a consensus seems to be building that inflation has gotten bad enough for the Fed to need to change course, and it looks like they're going to. So now we can enter a phase of hope that it makes a difference.

Your questions, answered.

Q: Did getting a positive Covid-19 test change your view on the virus or your political opinions about this stuff in any way?

— Logan, Ft. Myers, Florida

Tangle: Not really. I've always been pretty cautious about Covid-19. My experiences early in the pandemic were shaped by the devastation in New York City and the fact my mom was in cancer treatment when the pandemic started, which meant I was seeing the worst of it and had a loved one in the highest risk group possible.

It's been pretty well understood that the efficacy of the vaccines waned over time, and I'm just glad I had them. I wish I’d gotten my booster a couple of weeks earlier as it's possible it could have prevented me from being infected at all. Throughout the pandemic I was never particularly worried about what would happen to me if I got Covid, though — my age group and health status make me low-risk. I've always taken the precautions I did to mitigate the risk to my family members who were older, high-risk, pregnant, or extremely young. None of that really changes.

And I also took some calculated risks. I'm not a shut-in: I ate indoors this past weekend. I went to a concert two weeks ago (my first one since the pandemic started). I've been seeing friends. Every single person I know in my immediate friend group is taking these risks too: Eating inside, going to the gym, going to the movies, etc. So I always knew it was possible, but I also wasn't willing to sacrifice another year of my life when I was fully vaccinated and taking precautions where it seemed necessary. My only regret, really, is that I wasn’t more careful in the last week or two, that way I could have been 100% certain.

Want to ask a question? You can reply to this email and write in (it goes straight to my inbox) or fill out this form.

A story that matters.

The Pew Research Center released its latest examination of the U.S. religious composition, something that is tied closely to political affiliation and beliefs. Self-identified Christians (including Protestants, Catholics, members of the Church of Jesus Christ of Latter-day Saints, and Orthodox Christians) now make up 63% of the U.S. population, down from 75% a decade ago. 29% of Americans are now religiously unaffiliated. Fewer than half of U.S. adults now pray daily (45%) down from 58% in 2007, though the number that pray weekly or monthly is up to 32% from 22% over that same time period. 4% identify as atheist and another 6% affiliate with religions besides Christianity, including Judaism, Islam, Hinduism, and Buddhism. You can read the full report here.

Numbers.

- $3.48. The average price of a gallon of gasoline in November, according to the BLS.

- $2.97. The average price of a gallon of gasoline in May, the last time it was under $3.00, according to the BLS.

- $1.83. The average price of a dozen Grade A eggs in September, according to the BLS.

- $1.71. The average price of a dozen Grade A eggs in November, according to the BLS.

- $7.7 trillion. The cost of the latest defense spending bill, if you priced it over 10 years.

- 69%. The percentage of Americans who disapprove of Biden's handling of inflation, according to the latest ABC-Ipsos poll.

Don't forget.

If you're already a member, you can spread the word about Tangle with a quick email we've drafted up for you. Just click here.

Have a nice day.

A once homeless British man is being dubbed "Mr. Christmas," after decorating his new home with 17,500 Christmas lights in an effort to raise awareness about the charity that changed his life. Mark Abbott was juggling three jobs to try to keep a roof over his head when he lost the home he was renting and fell behind on a car payment. After couch surfing and living out of his car, he enlisted the help of St. Martins, a hostel in Norwich, where he stayed for nine months while saving up money for housing. Now, he's raising money for the same hostel that helped him. Big Issue has the story.

Member comments