I’m Isaac Saul, and this is Tangle: an independent, ad-free, subscriber-supported politics newsletter that summarizes the best arguments from across the political spectrum on the news of the day — then “my take.”

First time reading? Sign up here. Would you rather listen? You can find our podcast here.

Today's read: 13 minutes.

Biden's new budget plan was released on Monday. Plus, a question about how the Fed manages inflation.

Quick hits.

- The Kremlin said yesterday's peace talks did not result in any breakthroughs, despite Western reports to the contrary, and Ukraine reported continued air strikes overnight despite Russia's claims of reduced military operations. (The latest)

- Sen. Susan Collins (R-ME) said she intends to vote for Supreme Court nominee Ketanji Brown Jackson. (The commitment)

- President Biden signed the Emmett Till Anti-Lynching Act into law yesterday, making lynching a federal hate crime for the first time. (The bill)

- The FDA authorized a second Covid-19 vaccine booster for Americans aged 50 and up. (The shot)

- Poland announced it would end Russian oil imports and Germany issued a warning about low natural gas levels, calling on citizens to conserve energy. (The changes)

Want to ask a question? You can reply to this email and write in (it goes straight to my inbox) or fill out this form.

Today's topic.

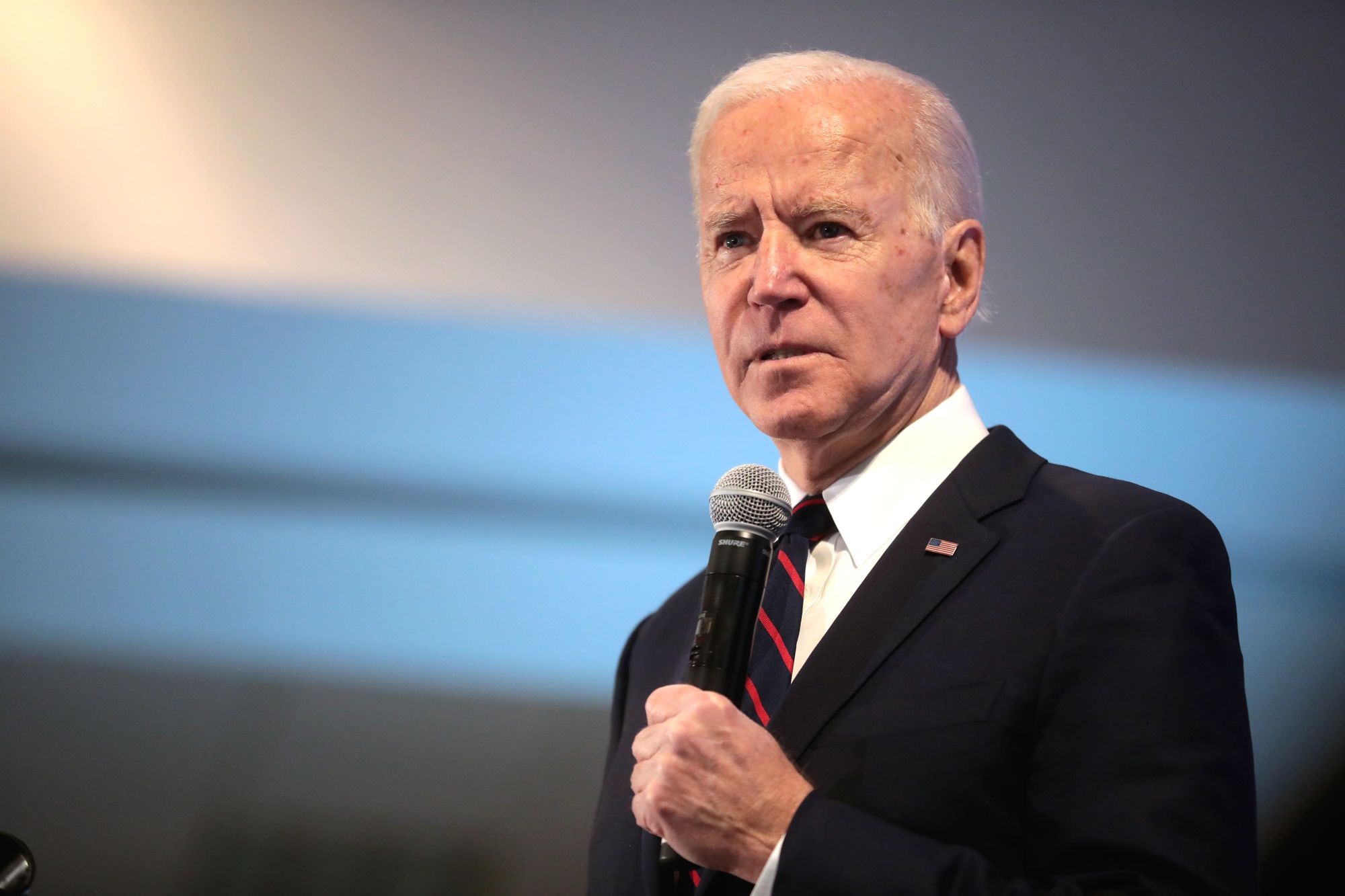

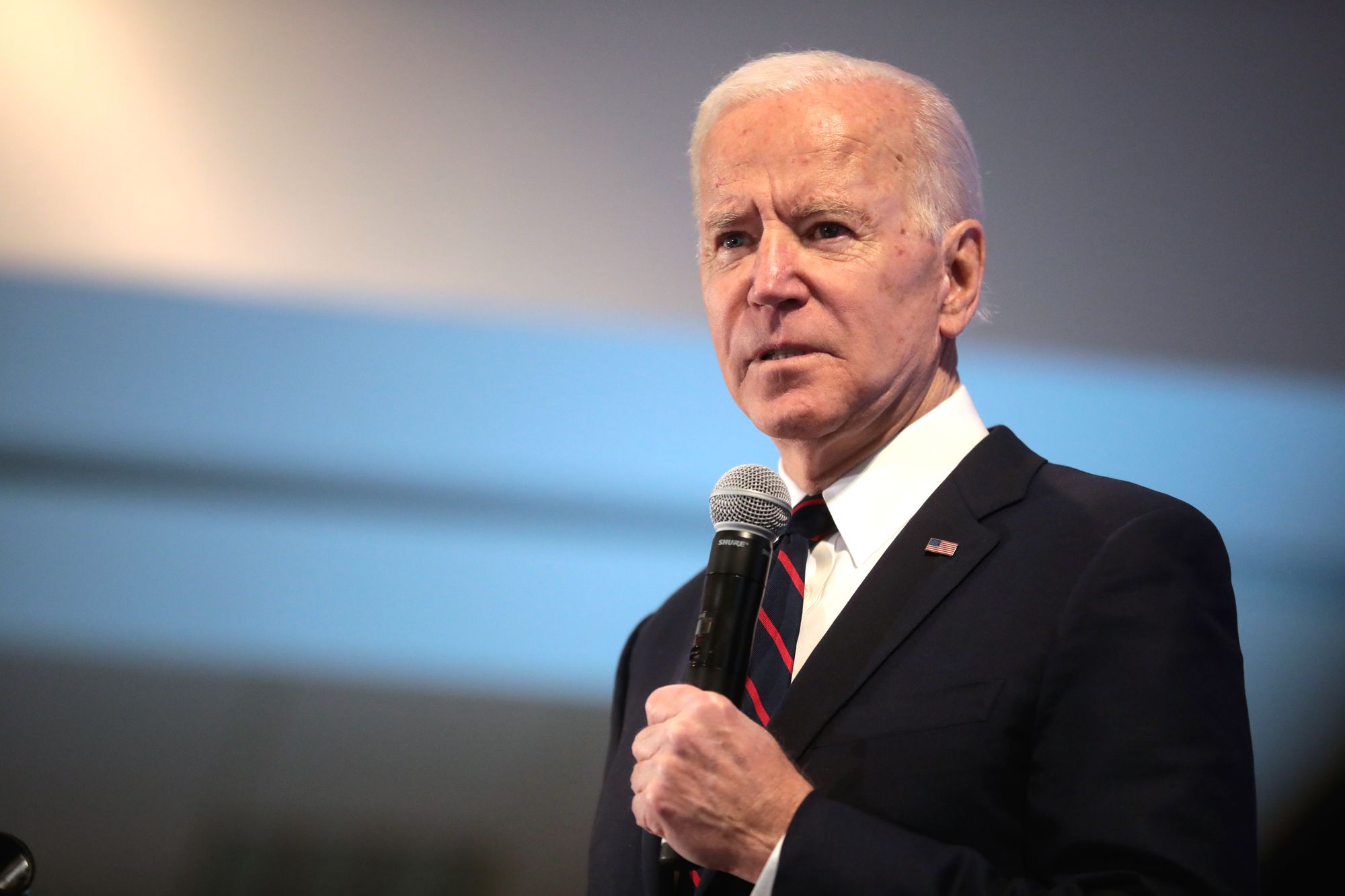

Biden's budget. On Monday, President Biden unveiled a new budget for fiscal year 2023. A White House budget like this is not a binding document; it is more like a baseline from which to begin negotiations, and sometimes a party agenda statement for Washington D.C. to squabble over. Many consider it little more than symbolic, while others view it as a document that creates the boundaries for federal priorities. So heading into the midterms, the budget is an important look at the administration's goals. In the summer and fall, Congress will use the budget as a foundation to craft spending bills like the one Biden just passed.

The headline news is that the budget increases domestic spending by 7% over last year but also aims to reduce the nation's deficit (the year over year debt) by $1 trillion over the next 10 years. The budget totals $5.8 trillion for 2023, a 31% increase from 2019, the last pre-pandemic budget year, and calls for increased spending on the military and for police across the U.S. The White House plans to reduce the deficit despite this increase through major tax hikes on the wealthiest Americans.

Biden's new taxes on the wealthy would require American households worth more than $100 million to pay a rate of at least 20% on their income, as well as unrealized gains on their liquid assets like stocks and bonds (which are currently taxed only when sold). The budget also raises the top marginal tax rate from 37% to 39.6% and raises the corporate tax rate from 21% to 28%.

The plan calls for $773 billion in military spending, a 10% increase for the Pentagon. It includes $32 billion to increase state and local police staffing, $70 billion for the FBI to address violent crime, $17 billion to crack down on illegal gun sales, and a 13% increase in spending for the two major immigration law enforcement agencies ($15.3 billion for Customs and Border Protection, $8.1 billion for ICE). There is also $309 million for border security technology and $19 million for border fencing and other infrastructure.

Biden's plan also calls for enacting the "Bipartisan Unity Agenda" that he announced in his State of the Union address, which focuses on cancer prevention, mental health care and veterans services. There is also $45 billion spread across the federal government to address climate change, which is an increase of $16.7 billion over the 2021 enacted level, according to The New York Times.

There is a 29% increase in spending on Veterans Affairs and $3 billion for veterans homeless programs. The education and housing departments also see 21% increases in their budgets.

Many observers view the new budget as a "pivot" to a more moderate agenda. In Biden's first year, the budget would have increased the nation’s deficits over 10 years by almost $1.4 trillion, with a focus on sweeping social policy programs. While the debt would keep growing if all the proposals in this year’s budget were enacted, the annual deficit would shrink every year after the budget was enacted. “We’re making real headway cleaning up the fiscal mess I inherited,” Biden said when he announced the budget. “We’re returning our fiscal house to order.”

Below, we'll take a look at some reactions to the budget from the left and right. Then my take.

What the left is saying.

- Some on the left are critical of the budget, panning Biden for abandoning some of the large social policies he ran on.

- However, many are supportive of the increased tax on the wealthy.

- Some consider the budget flawed, but also recognize that it meets the moment.

In CNN, Jill Filipovic said the budget will cause a "red wave in November."

"President Joe Biden's proposed budget makes one thing clear: Despite progressive hopes that the President might be a secret Franklin Delano Roosevelt capable of ushering in an ambitious domestic agenda, Biden is exactly the timid moderate he always appeared to be," she wrote. "He seems to be hoping that an agenda of the same old tacking-right policies will benefit vulnerable Democrats in the midterms. Instead, he may simply be depressing Democratic enthusiasm and helping to consign the party to a red wave.

"Almost $70 million of the Biden budget would go to the FBI to fight violent crime, while $30 billion would be set aside for police and for community programs aimed at decreasing violent crime. The money for anti-violence programs is laudable and could have a real impact. But most of the proposed budget funding isn't for community efforts; it's for more policing," Filipovic wrote. "Biden himself put it best. 'Budgets are statements of values,' he said in a statement. What does it say about Biden and his administration that they prioritize policing and militarism, but don't make sufficient investments in policies that the future of the nation hinges on: child care, for example, and fighting climate change?"

The Washington Post editorial board called it "insufficient, incomplete and... pretty good."

"As he has before, Mr. Biden proposed more spending and substantial tax increases to pay for it. Much of the new spending is sorely needed," the board wrote. "Rather than offering free college for all, Mr. Biden proposed beefing up Pell Grants, which assist poor students rather than wealthier ones who do not need aid. More Internal Revenue Service funding would improve taxpayer support services and enable the agency to better crack down on tax cheats, who place more burdens on those who play by the rules. More election assistance money would enable states to secure voting systems and make absentee ballots postage-free.

"The White House claims Mr. Biden’s plan would cut deficits by more than $1 trillion over the next decade, in part by hiking corporate taxes," the board added. "This nod toward fiscal responsibility contrasts with a bipartisan consensus that seemed to be emerging — that deficits do not matter. Yet the Committee for a Responsible Federal Budget notes that deficits would still total $14.4 trillion over the next decade, in part because Mr. Biden’s plan would fail to overhaul old-age retirement programs such as Medicare, continuing the national debt’s rise into alarming territory... Despite these shortcomings in the spending blueprint, if Mr. Biden persuades Congress to accept many of the proposals he outlined Monday and gets even a slimmed-down Build Back Better bill over the finish line, he could claim substantial victories for himself and for the Americans who elected him."

In New York Magazine, Jonathan Chait said U.S. politics is still a class war.

"A large swath of commentary about American politics is built on the premise that the Democratic Party represents the economic elite, while Republicans are the party of the working class," Chait wrote. "But while the voting bases of the two parties have changed some, and the thematic content of American commentary has changed a lot, the prosaic reality has changed very little. The main battle lines between the two parties are fixed around Democrats proposing more redistribution and Republicans proposing less. That reality has been highlighted once again by President Biden’s new plan to tax the income of billionaires.

"Democrats have long wanted to find a way to tax wealth, since one of the problems with the tax code is that enormous fortunes can accrue and be passed from generation to generation without any tax at all," Chait continued. "Figuring out how to tax that wealth presents both a technical problem and a political one. The political problem is that the legal basis for taxing wealth, as opposed to income, is unclear... The technical problem is finding a way to fairly and efficiently tax the income wealthy people enjoy from their accrued savings... It’s clear, however, that the thrust of the opposition on the right has nothing to do with the program’s design and everything to do with its objective."

What the right is saying.

- The right is critical of the budget, saying Biden pretends it is fiscally responsible despite being a spending bonanza.

- Many are upset about the wealth tax, arguing that it will stymie businesses and eventually expand to middle class Americans.

- Some say the money on the military is laudable, but being spent in the wrong way.

The New York Post said the budget would be laughable if it weren't so alarming.

"Team Biden, for example, brags about its 'fiscal responsibility,' arguing that a plan to spend a jaw-dropping 32% more than just four years ago cuts the deficit in half. Umm, only because the prez spent so much in 2021," the board wrote. "That includes the Democrats’ $2 trillion COVID 'stimulus package' when the economy needed no stimulus, and so fueled today’s rampant inflation. Plus the $1.2 trillion infrastructure bill, though not the $5 trillion the prez wanted for the “Build Back Better” bill (which he still hopes to pass).

"Biden’s supposed deficit-reduction also relies on crushing new taxes — raising corporate rates from 21% to 28%, for example. Plus a bid to set a minimum 20% tax on households worth more than $100 million that would hit income and unrealized gains on stocks and other assets," it added. "It’s likely unconstitutional, probably unworkable — and won’t pass, since at least two Democratic senators voiced opposition the last time the idea came up. Another knee-slapper: Biden touts his plan’s new outlays for national defense and law enforcement. Yet his national-security spending, including outlays for the Pentagon, would rise by just 4.5% — less than inflation. And while he’d pump $32 billion more into what he calls crime-fighting, much of it is for stuff like 'community violence intervention' that does little to help our cities."

The Wall Street Journal editorial board said "so much for Biden's pivot to the political middle."

"The fiscal 2023 budget he unveiled Monday re-proposes most of the bad ideas that haven’t passed Congress and adds a new one—a tax on wealth that he refused to endorse as a candidate in 2020. On the economy, he’s pivoting further left—presumably to fire up sullen progressives in November. The White House is proposing a new 'billionaire minimum income tax,' which the Federal Trade Commission would call false advertising if a private company tried that description," the board wrote. "The tax isn’t limited to billionaires and it applies to more than income. It’s a new tax on Americans with $100 million or more in assets whose effective tax rate in any year is less than 20% of their income.

"But these taxpayers already pay a 23.8% tax rate on capital gains and 37% on ordinary income," it said. "The average tax rate for the top 1% of taxpayers in 2019 was 25.6%. Here’s the Biden trick: The 20% minimum tax rate would apply both to ordinary income and the increase in the value of assets in a given year. This means taxing unrealized capital gains, which currently aren’t taxed until assets are sold and income is actually realized. The Administration says the tax would apply only to the top 0.1%—meaning hundreds of successful entrepreneurs and small business owners who accumulated wealth over decades through innovation and hard work. But these new taxes always start out applying to a few and then spread to millions. The income tax in 1913 applied a 7% top rate on taxpayers making more than $500,000 ($14.5 million today). The Alternative Minimum Tax was created in 1969 as a flat 10% tax on the uber-rich but grew to cover tens of millions in the middle class."

In Reason, Ira Stoll says Biden is trying to pass an unconstitutional wealth tax — again.

"Many of the same problems that applied to the original Biden-Wyden wealth tax apply to this new iteration of it," Stoll wrote. "It could well be unconstitutional. Its retroactive application violates a principle of the rule of law. The small number of people targeted by it raises concerns about consent of the governed and about taxation without representation. There are practical issues having to do with the valuation of assets whose value may fluctuate wildly over time. We should be figuring out ways to ease the burden of taxation and shrink the size of government, not moving in the opposite direction. The money would be better used by the rich people who own it than by the lobbyist-influenced politicians in Washington.

"One could have some fun, though, with these two concepts on which Biden-Wyden II reportedly relies—prepayment and 'illiquid… may opt to pay later with interest.' What if the rest of the taxpayers applied the same principle to the federal government, under the theory that turnabout is fair play?" Stoll added. "I'd send the government an invoice for the future value of all my Social Security and Medicare benefit payments. They'll owe it to me eventually anyway, so demanding the money now is just ‘a prepayment of…obligations’ the government ‘will owe…later.’ Also, I'd like the value of the future defense spending and Social Security and Medicare spending that my children and possible future grandchildren will benefit from. I'd like that money from Washington now, as a prepayment, please."

My take.

I'll start with the big news here, which seems to be the wealth tax. Then I'll explain what I think this budget means for the politics of the next year.

There is a basic emotional element to this for me, which is that I find the left's argument — that the richest Americans have somewhere between obscene and immoral wealth — pretty compelling. I know an increasing number of conservatives are feeling this way, too, though they tend to express that concern by focusing on the working class Americans getting screwed rather than the wealthiest Americans hoarding all the money (I really see this as two sides of the same coin).

When you understand that some 44% of U.S. workers are employed in low-wage jobs paying a median salary of $18,000, it's pretty hard to feel bad for a single person getting taxed on $100 million in assets (the equivalent of 5,555 $18,000 salaries ). I grew up around a lot of middle and lower-middle class Americans, and I hear every day from readers who can't afford $5 a month or $50 a year to pay for Tangle, which is part of why I keep most of the newsletter free. It's easy to empathize with the idea we should redistribute wealth to those folks, or at least to the services they use. I view those Americans as my Americans, the people I know and love, and I have very little attachment to any of the top 0.01%.

The counter-argument I find most compelling, though, is not that this would destroy businesses or stop entrepreneurship. It's that, historically speaking, there seems to be little doubt that these taxes will ultimately expand in reach. Once the government collects this money, they rely on it, and once they rely on it, they need more people to be covered by these taxes to get more money. Simply put, that is what has happened over and over. The beast, in essence, is never satiated. As The Journal noted, the income tax in 1913 applied a 7% tax to the wealthiest Americans (those making the equivalent of $14.5 million in today's cash). In 2021, the lowest income tax rate was 10% on anyone making $0 to $9,950.

I really just don't know how I feel about this. The upside, in the immediate, seems obvious (so long as the new revenue goes towards programs I like!). The inevitable expansion of this tax, though, seems hard to deny. I appreciated Jason Furman's piece in The Wall Street Journal defending the plan, which I thought made a great argument for the tax while also conceding the constitutional issues it is going to run into — namely that the whole thing might just be illegal. But a better solution to me seems to be not creating a new tax that, historically speaking, will just end up applying to a larger and larger chunk of American taxpayers. Instead, we could simply increase the top marginal tax rate — which was above 50% between 1935 and 1986 — and hasn’t been above 40% since then.

As for the budget on the whole, it looks like an obvious pivot to me. I know The New York Post and Wall Street Journal editorial boards may not feel that way, but I read this budget as something that could have easily been crafted by Joe Manchin (D-WV). The obvious intent is to inoculate the administration from claims it doesn't care about crime, inflation or the military, and it should serve that purpose well. Certainly, enough progressives are pissed off about it that you'd think some moderates would be satisfied. But will it win any votes? I'm skeptical.

In the near term, what Biden needs to do is turn out voters in the midterms, an election cycle that relies heavily on the most partisan and active voters in America. He may have been better off playing to the Democratic base. To me, this budget looks like a winning agenda in 2024. But in 2022? I'm much less certain. Just look at the closing line in Jill Filipovic's piece: "Budgets are indeed statements of values. And Democrats would be justified in wondering if Biden's values align with ours." For Biden’s sake, he’d better hope that is not the question at the top of mind for his base of voters.

Have thoughts about "my take?" You can reply to this email and write in or leave a comment if you're a subscriber.

Your questions, answered.

Q: How does the Fed raising interest rates help combat inflation?

— Anonymous, Fayetteville, Arkansas

Tangle: The Federal Reserve's mandate is to promote maximum employment, keep prices stable and shoot for inflation to be around 2% annually. One of the strongest tools it has for doing this is interest rates. In simple terms, interest rates are the amount a lender charges a borrower on the money it lends. So, a 10% interest rate on $100 means a borrower has to pay back $10 of interest on that loan in addition to the money lent (which means $110 total).

Because inflation is driven in part by consumers' ability to spend a lot of money, changing the interest rates can impact inflation because it reduces or increases how much we're willing to spend. When interest rates are low or zero, as they have been for awhile, it encourages borrowing, investing and spending. When they are high, it discourages that same borrowing (because it’s now more expensive). When there is less money to borrow, people are less likely to spend (especially on major purchases like houses and cars). The Fed’s interest rates can also have an impact on credit card interest rates.

The Fed gets to set the short-term interest rate for commercial banks, which the banks then pass on to consumers. By raising the interest rates, the hope is that consumers and businesses will borrow or invest less, which reduces demand, which brings prices back down. The risk many economists warn about is that if interest rates are raised too quickly or by too much, it could do so much damage to the economy that it triggers a recession. That is the major concern the Fed is trying to navigate right now.

Want to ask a question? You can reply to this email and write in (it goes straight to my inbox) or fill out this form.

A story that matters.

In a new bipartisan House bill, Americans will be able to boost savings rates in their 401(k)s. The bill, dubbed Secure Act 2.0, passed 414 to 5 in the House and raises contribution limits for older workers. It also lets companies offer employees a small cash bonus for simply signing up for the plan, and raises the age requirement to begin withdrawing from 72 to 75 over the next decade. (When people are required to withdraw the money, they also have to pay taxes on it.) "For aging people with healthy bodies and healthy bank accounts, the plan would provide significant advantages," the Journal reports. "In the short term, 'It feels like a tax cut,' said Mark Iwry, a senior fellow at the Brookings Institution." The WSJ has the story.

Numbers.

- $50 billion. The amount of money in Biden's budget proposal that will go toward affordable housing.

- $813 billion. The amount of money requested for the national defense budget.

- $287 million. The amount of money requested for the Justice Department's Antitrust Division, a 49% increase from what Congress enacted this year.

- $18 billion. The amount of money requested to address worsening wildfires, floods and storms caused by climate change.

- $11 billion. The amount of money requested to help other nations transition to solar and wind energy sources.

- $81.7 billion. The amount of money requested over five years for pandemic preparedness and bio defenses.

Have a nice day.

In four short years, Chloe Campbell went from waiting tables at the Coffee Pot to owning the cafe. The 19-year-old was 15 when she started working at the cafe in Dufftown, Scotland. She put nearly all of her paychecks into a savings account while living with her parents. In September, while talking to the owners about one day opening her own cafe, they made an astounding offer: She could buy the one they were standing in. Campbell said she was able to take over the business and pay the monthly lease, and she is now learning to manage the Coffee Pot's six employees. BBC News has the story.

❤️ Enjoy this newsletter?

💵 Drop some love in our tip jar.

📫 Forward this to a friend and let them know where they can subscribe (hint: it's here).

📣 Share Tangle on Twitter here, Facebook here, or LinkedIn here.

🎧 Rather listen? Check out our podcast here.

🛍 Love clothes, stickers and mugs? Go to our merch store!

🙏 Not subscribed? Take the next step and become a subscriber here.

Member comments