I’m Isaac Saul, and this is Tangle: an independent, nonpartisan, subscriber-supported politics newsletter that summarizes the best arguments from across the political spectrum on the news of the day — then “my take.”

Are you new here? Get free emails to your inbox daily. Would you rather listen? You can find our podcast here.

Today's read: 12 minutes.

From today's advertiser: Why settle for mediocrity when you can have the best of both worlds? That’s why we turn to Odyssey Snacks. Their all-natural, prebiotic protein bars pack a punch of delicious flavor, with the added bonus of prebiotics for gut health.

What we love about them:

- Nut butter based, so they’re easy to chew and not chalky

- A good source of protein; 13g-16g per bar

- No need for refrigeration (making them perfect for on-the-go snacking!)

And the best part? As a reader of Tangle you can get 20% off your first box of Odyssey Snacks and say goodbye to bland bars for good. Check them out here.

Correction.

In Thursday's edition on the new January 6 footage, we erroneously referred to Michael Fanone as a Capitol Police officer. In fact, Fanone was a member of the Washington D.C. Metropolitan Police Department (MPD), whose officers vastly outnumbered the Capitol police on the day of the riots. Similarly, the figure "140" that we described as the number of Capitol Police assaulted was actually the total number of officers assaulted, nearly half of whom were MPD.

This is our 79th correction in Tangle's 189-week history and our first correction since February 9th. I track corrections and place them at the top of the newsletter in an effort to maximize transparency with readers.

Reader mailbag.

In Friday's subscribers-only post, I answered 15 different reader questions in one email. The questions covered everything from allegations Rep. Ilhan Omar married her brother to my favorite things about Philadelphia to what five Constitutional amendments I'd push for right now if I could. Friday editions are for paying Tangle members only, but you can subscribe and read the edition by going here.

Quick hits.

- U.S. regulators shut down Silicon Valley Bank over the weekend after it suffered a bank run, then announced emergency measures to protect depositors. It was the second largest failure of a financial institution in U.S. history. (The moves)

- The House voted unanimously on Friday, 419-0, to declassify U.S. intelligence information about the origins of Covid-19, sending the bill to President Joe Biden's desk. (The vote)

- President Biden is expected to approve a "massive" oil project from ConocoPhillips on federal land in the Alaskan tundra. (The project)

- The Mexican Gulf cartel apologized for the kidnapping of four American citizens that resulted in two deaths, condemning the violence and turning over the gang members who were involved. (The apology)

- The U.S. economy added 311,000 jobs in February, outpacing economists expectations of 225,000, while wages grew more slowly than expected. (The numbers)

Today's topic.

Biden's budget. On Thursday, President Joe Biden released a $6.8 trillion budget plan for 2024 that he says will cut deficits by $2.9 trillion over the next decade, increase military funding, raise taxes on the wealthy and corporations, and pay for Medicare and Social Security without any major cuts or reforms to the programs. While the budget increases the military’s budget, it represents a decline in military spending as a share of the overall U.S. economy in the next decade.

Budget plans like this one are political documents that give a president the chance to lay out their agenda. Biden's plan, in a divided Congress, has very little chance of being enacted. Instead, it acts as a distillation of his goals as president, and his priorities heading into the final two years of his first term.

The budget covers the next 10 years, and in that time estimates an additional $4.7 trillion in tax revenue and $800 billion in savings through changes to government programs. It also calls for $2.6 trillion in new spending, which subtracts from the total revenue to account for a $2.9 trillion reduction in the federal deficit.

Among other things, Biden's budget calls for the following:

- $885 billion in defense spending, including a 3.2% increase in the Pentagon budget, and $809 billion in non-defense and veteran's health programs

- $7 billion for military support for Ukraine

- A 25% “minimum tax on billionaires” to apply to the richest 0.01% of Americans, meant to address budget loopholes

- A top tax rate for people making more than $400,000 of 39.6%, up from 37%

- An increase of the Medicare tax rate from 3.8% to 5% on income exceeding $400,000 per year

- An increase in the corporate tax rate from 21% to 28%

- A removal of the tax subsidy for cryptocurrency transactions to raise an estimated $24 billion

- A restoral of the child tax credit, providing families up to $3,600 per child, and a change in how it’s granted so families who don't owe any taxes can still receive it

- A 15% increase in budget for the Internal Revenue Service, separate from the $80 billion it got last year

- $150 billion for home care for older Americans and disabled people

- $400 billion for expanded health coverage assistance through the Affordable Care Act

- $325 billion for guarantee paid leave for workers

- $300 billion for free community college and prekindergarten

- $25 billion for the U.S. Customs and Border Protection (CBP) and Immigration and Customs Enforcement (ICE) — $800 million more than they received in 2023

- $16.5 billion for climate science and clean energy research, and $23 billion for climate resilience against floods, wildfires and storms

- $4.5 billion for a clean energy workforce and infrastructure projects, including weatherizing and retrofitting low-income homes

- $19.4 billion for various crime prevention strategies and $5 billion for community programs to fight violence

- $2.8 billion for Biden's "cancer moonshot"

- $2 billion to strengthen Indo-Pacific economies and support partners in the region

- $400 million to "counter specific problematic" behavior from China globally

“I just laid out the bulk of my budget,” Biden said. “Republicans in Congress should do the same thing. Then we can sit down and see where we disagree.”

Today, we're going to take a look at some reactions from the right and left to Biden's budget, then my take.

What the right is saying.

- Many on the right criticize the budget for being irresponsible and vastly expanding the federal government.

- Some call it unserious and criticize the massive tax increases.

- Others say the budget does nothing to address Social Security and Medicare.

National Review's editors called it "Biden's unserious budget."

"Biden’s purpose is to advance the notion that our fiscal problems could be solved by a willingness to let the very wealthy pay just a little bit more — and to accuse Republicans of holding the country hostage to protect tax cuts for the rich," the editors wrote. "Unless Republicans can overcome their internal divisions and offer a serious alternative, such a strategy just might work politically. However, were we to judge Biden’s proposal as an actual effort in addressing U.S. fiscal problems, it would be an abject failure. The top-line numbers are that Biden’s proposal would raise taxes by $5.5 trillion and boost spending by $2.2 trillion over the next decade, as compared with the Congressional Budget Office baseline... While Biden claims $3 trillion in deficit reduction, this is measured against a baseline that was already inflated by the first two years of extravagant Biden spending.

"In February 2021, just after Biden was sworn in, CBO projected deficits of $14.5 trillion from 2021 to 2031. If adopted, the Biden policies would produce deficits of $18.9 trillion over the same period," the editors said. "In 2019, the year before the pandemic hit, annual spending was $4.4 trillion. Biden is trying to make yearly budgets of above $6 trillion the new normal, and then build on them. The White House projects that the budget for the year 2033 alone will blow past $10 trillion... To put the Biden budget in perspective, the only time U.S. debt has ever exceeded the size of the economy for two consecutive years was during World War II. In the Biden budget, according to the White House’s own estimates, U.S. debt would eclipse 100 percent of GDP in every single year of the ten-year projection period (2024–33)."

In The Daily Beast, Brad Polumbo said the budget was "economically reckless and socially clueless."

"President Biden is claiming his budget would reduce the federal budget deficit by $3 trillion. While perhaps true, at least under a series of rosy assumptions, that’s quite a spin on what it would actually do. According to the nonpartisan Committee for a Responsible Federal Budget (CRFB), the national debt would hit a new record by 2027 under Biden’s plan," he wrote. "Total federal debt would increase by an astounding $19 trillion over the next decade. The national debt would reach 110 percent of GDP by 2033, meaning we’d owe significantly more in debt than our economy produces in an entire year. That means slower economic growth, less private sector investment in the economy, and trillions in taxes just to cover the interest payments.

"Oh, and while Biden is boasting about how unlike those mean Republicans, his plan doesn’t cut Social Security, that also means it does nothing to fix Social Security," he said. "As a result, it effectively, through inaction, endorses the automatic sharp benefit cuts that will occur when Social Security becomes insolvent in 2033. Without actual reforms, benefits will be cut by at least 23 percent at that point, according to the Congressional Budget Office. And while Biden claims that his budget shores up Medicare, it does so in part with budget gimmicks that don’t actually equate to real savings, according to Manhattan Institute economist Brian Riedl.”

In The Wall Street Journal, Casey Mulligan said it was "an assault on Social Security."

"Economic growth has worked miracles, producing new technologies, sharply reducing world poverty, and inventing the concept of retirement—a stage of life that previous generations never enjoyed," Mulligan said. "The Biden budget’s degrowth agenda would sacrifice all that in pursuit of vaguely defined social and environmental goals. It’s no coincidence that real wages have fallen during his administration while real investment returns have turned negative. Retirement savings plans have lost $4 trillion in value since Mr. Biden’s inauguration, according to a report by the Committee to Unleash Prosperity.

"My own research on the Biden agenda’s effect on Social Security and Medicare makes clear that low economic growth translates into smaller benefits for seniors. These programs give the elderly a share of the earnings of the nation’s current workers," he wrote. "The more people who work, and the more each worker earns, the more payroll tax revenue is available to fund Social Security and Medicare. I estimate that degrowth policies since 2020 will cumulatively reduce Medicare and Social Security tax revenue by at least $400 billion—and perhaps as much as $900 billion. The tax base will shrink even more if Mr. Biden succeeds in levying higher wealth and business taxes."

What the left is saying.

- The left is mainly supportive of the budget's outlines, though some criticize it for not properly addressing the debt.

- Many argue the numbers add up and are a great statement of Biden's political goals.

- Others suggest Biden should have a more complete plan to reduce debt as a share of the U.S. economy.

In The New York Times, Paul Krugman argued that at least Biden's budget makes sense.

"The Biden budget may be political theater, but its numbers make sense. The Republican numbers don’t," Krugman wrote. "The starting point for this budget is that Biden’s people evidently view deficits as a source of concern, but not a crisis. Overall, Biden’s budget proposes increasing social benefits on a number of fronts even in the face of rising debt. It nonetheless proposes to reduce the budget deficit, but only modestly — yes, it claims to shrink the deficit over the next decade by almost $3 trillion, but that’s less than 1 percent of G.D.P. How can Biden reduce deficits while expanding social programs? Mainly by raising taxes on corporations and wealthy individuals, with an assist from cost-cutting measures in health care, especially using Medicare’s bargaining power to reduce spending on prescription drugs.

"Are Biden’s numbers plausible? Yes. Notably, the economic projections underlying the budget are reasonable, not very different from those of the Congressional Budget Office. The projections even assume a substantial but temporary rise in unemployment over the next year or so," Krugman wrote. "What about the Republicans? They claim to believe that rising federal debt is a major crisis. But if they really believed that, they’d be willing to accept at least some pain — accept some policies they dislike, take on popular spending programs — in the name of deficit reduction. They aren’t. The [proposal from Donald Trump's budget director Russell Vought] calls for preserving the Trump tax cuts in full, while also avoiding any politically risky cuts in defense, Social Security or Medicare. Yet it also claims to balance the budget, which is basically impossible under these constraints."

In The New Republic, Grace Segers said the plan "hits Republicans where it hurts."

"Biden’s budget would spend billions of dollars in funding for public housing, free community college, child care, and universal pre-kindergarten, all proposals included in the Build Back Better Act," Segers wrote. "It would also reinstate the enhanced child tax credit expanded by a 2021 coronavirus relief measure, which contributed to a dramatic cut in child poverty during the one year that it was in effect. The budget also includes an increase to Medicare tax rates for people earning more than $400,000 per year in an effort to keep the program solvent and expand Medicare’s ability to negotiate prescription drug prices... It also hikes taxes on large corporations, hedge fund managers, stock buybacks, and billionaires.

"While congressional Democrats tacitly acknowledged the political impossibility of Congress actually acting on this wishlist, they nevertheless maintained that it sent a powerful message to Americans about the president’s priorities. It also provides Biden with another clear contrast with Republicans, who have yet to release their own budget proposal," Segers said. "Republicans are hoping to extract spending cuts in exchange for raising the debt limit—which we’ll remind you would not incur any new debts but cover spending already appropriated by Congress. As they have promised not to touch Medicare, Social Security, or Defense spending, Republicans will look to balance the budget likely by slashing programs that benefit poorer Americans, such as Medicaid and food stamps."

The Washington Post editorial board said Biden's budget "won't solve" the debt problem facing the United States.

"The nation has reached a hazardous moment where what it owes, as a percentage of the total size of the economy, is the highest since World War II," the board wrote. "If nothing changes, the United States will soon be in an uncharted scenario that weakens its national security, imperils its ability to invest in the future, unfairly burdens generations to come, and will require cuts to critical programs such as Social Security and Medicare. It is not a future anyone wants. Stabilizing the debt should be a top priority for Mr. Biden and Congress. That starts with setting a clear goal. A reasonable target would be aiming not to have the debt exceed the size of the economy (a 100 percent debt-to-gross-domestic-product ratio)... By 2033, the nation will be spending more on paying creditors than on the entire defense budget.

"Mr. Biden blasts former president Donald Trump for running up the debt with big tax cuts that weren’t paid for. That leaves out the inconvenient fact that he, too, added substantially to the debt with extra pandemic aid approved only by Democrats," they wrote. "Meanwhile, Mr. Biden’s boast that he has reduced the budget deficit by $1.7 trillion since taking office earned him three Pinocchios from The Post’s fact-check team because the bulk of the reduction was going to occur regardless of who occupied the White House as emergency pandemic aid ended... Stabilizing the debt might not be a catchy campaign slogan, but the concept is simple to understand. It means putting the nation on a sustainable path to ensure there is money to provide for everything from education to defense to Social Security, not to mention the next security or economic calamity."

My take.

Reminder: "My take" is a section where I give myself space to share my own personal opinion. If you have feedback, criticism, or compliments, don't unsubscribe. You can reply to this email and write in. If you're a subscriber, you can also leave a comment.

- These budgets are always a mix of good and bad, and nothing in this is particularly egregious.

- It still fails to responsibly address the debt, Social Security or Medicare, and any actual attempt to push budget cuts should include the military.

- Biden is right about one thing: Republicans need to release their own plan.

Anytime a budget proposal like this is released, I think it's worth separating the wheat from the chaff. As many others have noted, it's also worth reiterating that this budget won't become law and is, in every practical sense, little more than a political agenda.

Still, there are plenty of things for both sides to like. I've long been an advocate of the Child Tax Credit, which I think is a more direct way to support parents than current programs we have, and is something that would encourage more children in a country that very much needs them. I appreciate Biden resurrecting the program, which surprisingly died on the vine despite strong bipartisan support.

The budget also gives some attention to immigration, which is an important olive branch to conservatives. While I think our money would be better spent on technology, judges and lawyers than border patrol agents, an increase in spending along the border is reflective of the current crisis we're facing and reflects Biden's seriousness about trying to "do something."

I'm also comfortable with some of the increases in taxes. I don't think implementing all of the proposed tax increases would be wise, but that will never happen anyway. The proposal includes mostly recycled but still viable measures for raising new revenue. I've never come close to making $400,000 per year, so perhaps it's tough for me to sympathize with folks who do. Doubly so for the top 0.01% of Americans, whose income amounts to hundreds of millions of dollars a year. Still, there is nothing radical about an increase in Medicare tax rate and returning the top bracket of 37% to 39.6%. Both are totally reasonable proposals in my eyes — and would help bring in new revenue to cover our yearly shortfall.

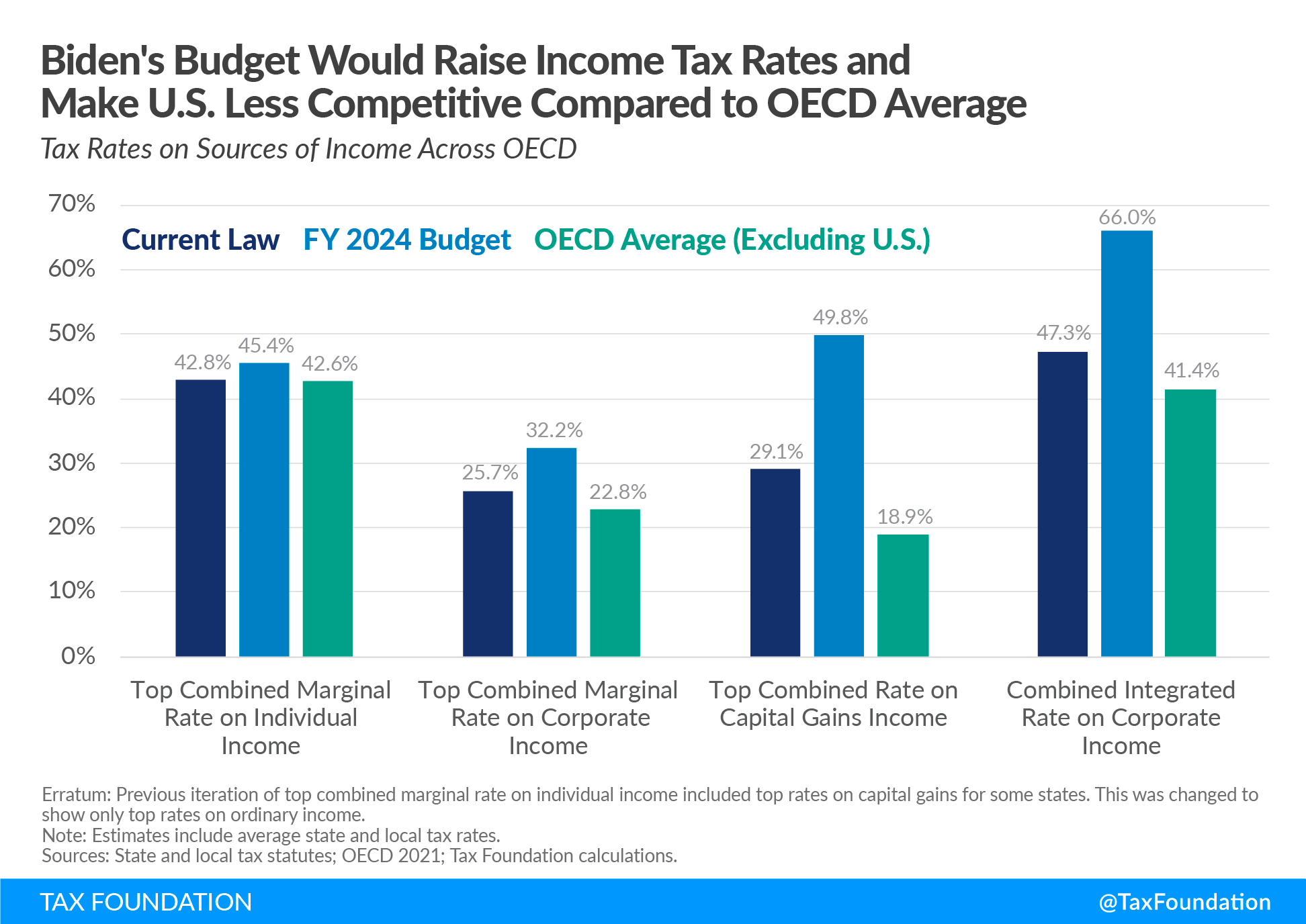

Corporate taxes are a lot more complicated. Anytime taxes are raised on corporations, workers typically bear the brunt of it. Our combined federal and state corporate tax rates are already fairly high among other OECD countries, and this budget would put us way outside the average.

It's not corporate, capitalist propaganda to say what would happen next: We'd lose a competitive edge in courting new and global businesses. This is why Biden is simultaneously hoping to push a global tax minimum to mitigate that disadvantage — but the idea is predictably meeting stiff resistance abroad.

The worst part of Biden's budget is that it does nothing to reform Medicare and Social Security — it simply finds new ways to squeeze out money from wealthy Americans to cover programs that aren't sustainable. As I wrote when we last covered Social Security, both programs require actual reform to retain long-term solvency and sustainability. On top of the American retired population growing, Americans are living longer and require more money for longer periods of time. The current math for supporting senior citizens simply doesn’t work, and even though it’s politically unpopular, bringing substantial change to these programs is the only way to ensure they don't go bankrupt.

Of course, any attempt to balance the budget will also require cutting our obscenely large military and defense programs, which also happen to be very, very wasteful. Instead, Biden is simply dumping more money in — more than even defense hawks could have asked for just a few years ago. Both sides will need to sacrifice some of their sacred cows to keep the size of our federal government and our debt under wraps, and for conservatives and many establishment Democrats, that means slimming our military and making it more efficient — even (or especially) at a time when the World War III fear mongers are sounding every alarm.

This proposal is neither a realistic nor unambiguously good or bad document, which is typical of budget proposals. In this day and age, that’s unsurprising and normal. One thing that Biden is right about, though: Republicans are up next. We're operating in a system dominated by two parties, and if Republicans have better plans on how to reduce the deficit, secure critical and popular programs, and continue to support our global economic and military prominence, they should come forward with them soon. Then, as both sides have promised, they can sit down at the negotiating table.

Your questions, answered.

Q: I've been a paid subscriber for a long time now and I read and enjoy your newsletter every day. I cannot remember you ever saying one good word about Trump despite the many good things he accomplished while in office. We had peace in the Middle East, China was being brought slowly into alignment with the rest of the community, we were energy independent and our economy was booming. There were many other highlights to his term in office. Would it have been much better for America if he had the personality of a Ronald Reagan? That would be a resounding "YES" for sure... But as an unbiased reporter as you claim you are, why do you ignore the good side of the Trump story? You ignored every accomplishment Trump had in that and every other arena. Why?

— Dave from Clearwater, Florida

Tangle: I appreciate the (partly) kind words. I don't know what a "long time" is, but if you think this is true, my assumption is that you haven't been reading Tangle for that long. To test my hypothesis, I took the liberty of looking up your email address and can see you signed up in March of 2022 — more than a year after Trump left office. This would explain why you haven't seen me write a ton about his accomplishments while in office.

When we covered Trump's presidency, I repeatedly praised him for his pre-Covid economic success, his criticisms of the D.C. establishment, his success in preventing any new wars, his approach to China, the red tape he cut to get us Covid-19 vaccines, and so many other things. You can find dozens of such articles in the Tangle archive. But if you want a place to start, in January of 2021, I wrote an entire edition reviewing his presidency. I suspect you'd find it pretty fair.

Trump is a news suck, and since he has left office I have done my best to focus on the actual people who are currently pulling the levers on running our country. Unfortunately for Trump, much of his relevance — as it relates to this current political moment — has to do with January 6, his candidacy for 2024, his ongoing refusal to acknowledge he lost in 2020, several high-profile investigations, and whatever potshots he is taking on social media. I don't think it’s fair to blame me for that. I still give him credit — or call out when Biden is basically mimicking his more popular and successful policies — whenever it’s appropriate.

Want to have a question answered in the newsletter? You can reply to this email (it goes straight to my inbox) or fill out this form.

Under the radar.

On Wednesday, the House voted 321-103 against pulling troops out of Syria, rejecting a war powers resolution that garnered an alliance of strange bedfellows in the House. The proposal was introduced by Florida Rep. Matt Gaetz (R), and was drafted in a way that would have required the Biden administration to withdraw roughly 900 troops within six months. Democrats from the Congressional Progressive Caucus joined libertarian and "America First" Republicans to rally for the bill. Defense News has the story.

Numbers.

- 56%. The increase in total corporate tax rates if Biden's budget is approved.

- ~$5 trillion. Inflation adjusted spending before the pandemic.

- ~$7 trillion. Inflation adjusted spending next year, if Biden's proposal is approved.

- $25 trillion. The current publicly held national debt in the U.S.

- $44 trillion. The projected publicly held national debt in the U.S. in 10 years, if Biden's proposal is enacted.

- $10 trillion. The cost, over 10 years, of paying interest on that national debt.

The extras.

- One year ago today, we didn't have a newsletter, but I had just penned a response to reader feedback about our coverage of Florida's parental rights bill.

- The most clicked link in Thursday's newsletter: The story about Russia's attempt to influence the 2022 midterms.

- Not buying it: 52.97% of Tangle readers describe the January 6 protests as "mostly violent," while 25.2% said "somewhat violent” and 4.46% said "somewhat peaceful,” and 3.96% said “mostly peaceful.” About 13% said "I'm not sure" or "other."

- Nothing (really) to do with politics: I think my new favorite card game is Kemps.

- Take the poll: What do you think of Biden's budget proposal? Let us know.

Have a nice day.

When I say "surf’s up," the first thing that comes to mind probably isn't Lake Superior, Duluth, Minnesota, and blizzard conditions. But for Randy Carlson and a slew of other frosty surfers, "it's liquid ice, dude," is the only way to describe the waves they ride. At the end of February, while local residents were securing supplies and getting ready to hunker down for a blizzard, Carlson was hunting the perfect wave in Lake Superior with a growing tribe of thrill seekers who weather the cold out on the lake’s frigid waters. The largest recorded wave on the Great Lakes was a 28.8 foot monster in Superior in 2017, and in blizzard conditions there is plenty of surf to ride. The Wall Street Journal has the story about these cra — uh, very enthusiastic — athletes.

Don't forget...

In order to spread the word about our work, we rely heavily on readers like you. Here are some ways to help us...

📣 Share Tangle on Twitter here, Facebook here, or LinkedIn here.

💵 If you like our newsletter, drop some love in our tip jar.

🎉 Want to reach 55,000 people? Fill out this form to advertise with us.

😄 Share https://readtangle.com/give and every time someone signs up at that URL, we'll donate $1 to charity.

📫 Forward this to a friend and tell them to subscribe (hint: it's here).

🎧 Rather listen? Check out our podcast here.

🛍 Love clothes, stickers and mugs? Go to our merch store!

Member comments